Low credit score cash out refinance

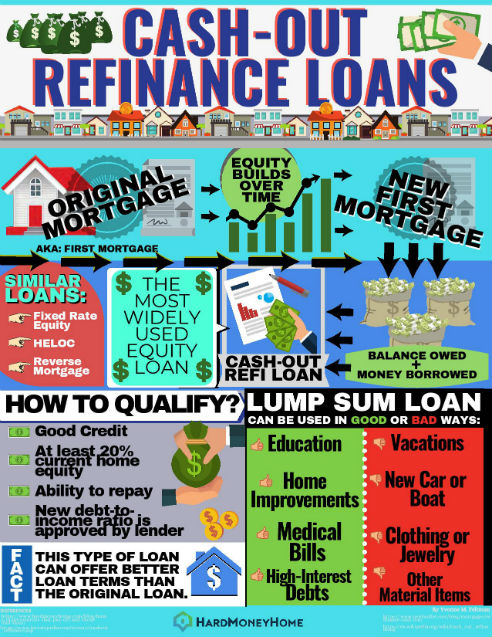

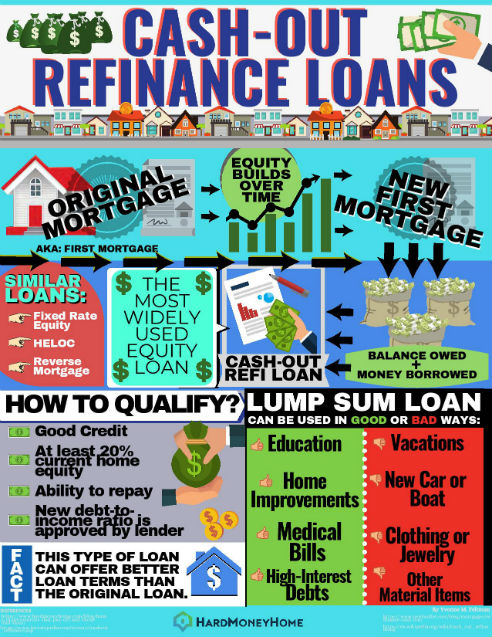

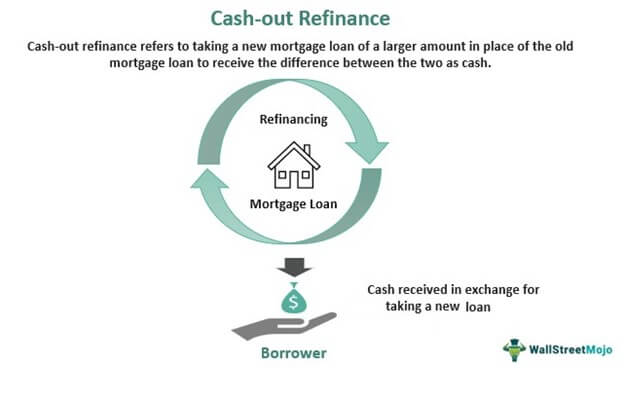

A Cashout Refinance is a way to borrow against the value of a property you already own. Applicants must also have between 1500.

Cash Out Refinance A Beginner S Guide Money Com

And you might be able to qualify with a credit score as low as 500 depending on the program.

. Most fha insured lenders however set their own. Cash-Out Mortgage Refi With Bad Credit. When you want an FHA loan cash out refinance we can often accept a minimum credit score of 550.

Shared Equity May Be The Best Solution. Ad No Monthly Payments. Get Prequalified Online in Minutes.

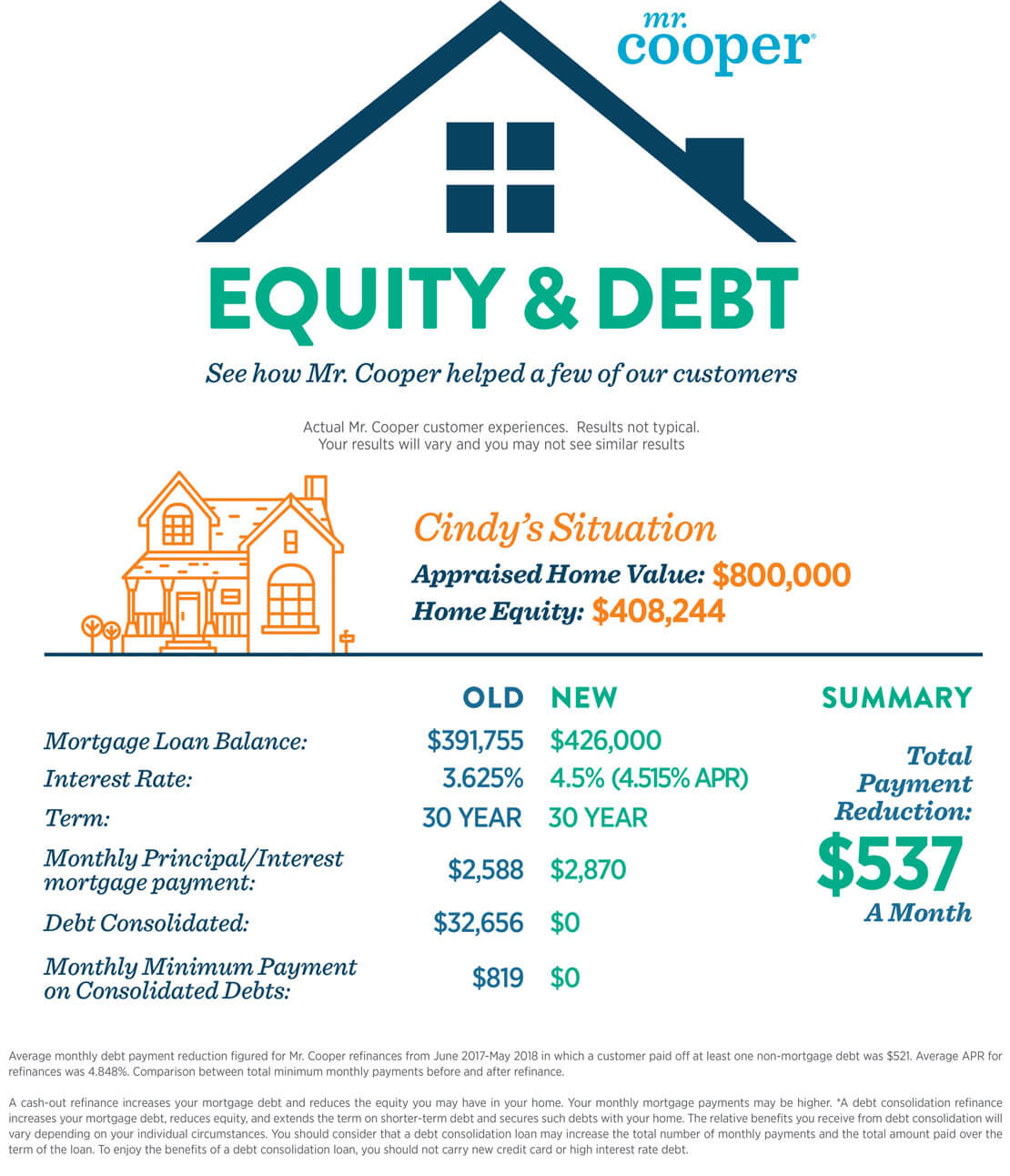

Get Started Refinance Today. Cash Out Refinance Low Credit Score 2022. Equity is the appraised value minus the remaining balance on the mortgage.

Minimum credit score needed. Cash out refinance loans are available for credit as low as 520. You know that credit card scores are required for all types of loans.

Ad Replace Your Existing Mortgage with a New Loan. Lock Rates For Up To 90 Days. Mortgage rates should stay low in 2022 making it a good time to.

Kabbage offers revolving credit lines to businesses of up to 150000 based on performance criteria and a credit score of 560 or higher. Apply Online Close a Loan In Just 25 Days. FHA loans also allow borrowers to use gift money to go toward the down.

The banks minimum credit score for refinancing an automobile is 540 whereas the minimum needed to purchase a vehicle is 500. See Cards Youre Pre-Approved for With No Harm to Your Credit. Get Up to 5 Auto Refinance Offers With 1 Form.

Get Your Loan In 24 Hours. You wont be able to go on a. Technically you can refinance an FHA loan with a credit score as low as 500.

What are the benefits of doing a cash out refinance on your home. Apply for a New Loan Through Cash Out Refinance. Ad Competitive Rates on Cash Out Refi Loans.

Find Out Why AmeriSave Has Financed 664000 Homes. As you can see with your current score of 520 you could be charged about 958. Lock Rates For Up To 90 Days.

In practice you typically need a. Youre using secured debt to pay unsecured. Use Our Risk-Free Pre-Approval Tool To Find Card Offers With No Impact to Your Score.

FHA Loan VA Loan Non-QM loan. Take The Time To Compare Rate Offers Choose The Lowest. Ad We Close Most Refinance Loans In About A Month.

Ad Compare Top Personal Loan Refinancing 2022. Your Options For Refinancing With Bad Credit. Apply With A Non-Occupying Co-Client.

A low credit score is still possible for cash out refinancing but it is important to note that lenders will check your DTI to ensure that you can qualify for the loan. One option is to apply for a refinance with a non-occupying co-client. If your credit score is at least 580 you may be able to make a down payment that is as low as 35.

Ad Apply With More Confidence. Cash-out refinance minimum credit scores CONVENTIONAL LOANS. Ad It Only Takes 3 Minutes To Get Your Rate.

Apply Online Close a Loan In Just 25 Days. Another way to overcome a low credit score is to have a higher equity stake in your home. Check Your Options for Cash Out Refinance.

A cash-out refinance allows you to borrow a new loan for. This process can be especially advantageous for those with low credit. Ad It Only Takes 3 Minutes To Get Your Rate.

You can most likely get a cash-out refinance if you have bad credit but it will ultimately depend on the lender the amount of equity you have in your home and. Ad Apply To Compare Rates From Multiple Lenders At LendingTree. Connect With Top Lenders.

The new loan can be up to 80 of the homes value. Get a Pre-approval from Top Lenders. If you have a low credit score you can still qualify for a cash-out refinance.

Unlike a rate-and-term refinance. But its very difficult to find lenders that allow such low scores. Must meet equity and income requirements.

However it will take some discipline to stay on top of payments. Up to 100000 in 24 hrs. It is vital that you understand your whole credit profile not just.

The best options for low credit cash out refinance are. The FHA requires a minimum credit score of 500 for a cash-out refinance but. Refinance with cash out and low credit score Its almost never a good idea to take equity out of a house to pay credit cards.

Most FHA insured lenders however set their own limits higher to. Your credit card score is much lower but you need cash. According to FHA guidelines applicants must have a minimum credit score of 580 to qualify for an FHA cash-out refinance.

These minimum credit scores are lower than scores you may see required by other. Take The Time To Compare Rate Offers Choose The Lowest. Compare Rates and Closing Costs.

An FHA cash-out refinance lets you tap into home equity.

5 Options For Refinancing With Bad Credit Quicken Loans

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

What To Know About Fha Cash Out Refinance Requirements And Guidelines Fox Business

How To Refinance A Mortgage With Bad Credit Money

The Cash Out Refinance Loan Delmar Mortgage

What Is A Cash Out Refinance Loan How Does It Work

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

Minimum Credit Scores For Fha Loans

Fha Refinance Loans For Homeowners In 2022

Cash Out Refinance Mortgage Refinance U S Bank

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Refinance Cash Out Loans Near Me Hardmoneyhome Com

Cash Out Refinance Meaning Examples How It Works

Cash Out Home Loan Refinance Refinance Your Mortgage Acu

What Is A Cash Out Refinance The Mr Cooper Blog

/Investopedia-terms-cash_out-refinance-V2-9b3bb93322934719ab4c5cfec6335f27.png)

Cash Out Refinance Definition

What To Know About Fha Cash Out Refinance Requirements And Guidelines Fox Business